This is my 4th experimental bet. You can read about my previous bets here.

As before, the intention is to seek feedback from the market and any generous reader; and for these bets to act as live case studies as I continue down my reading list on momentum investing and speculation.

Trade Summary

Bought Muthoot Finance @ Rs1,214 on 17 July 2020

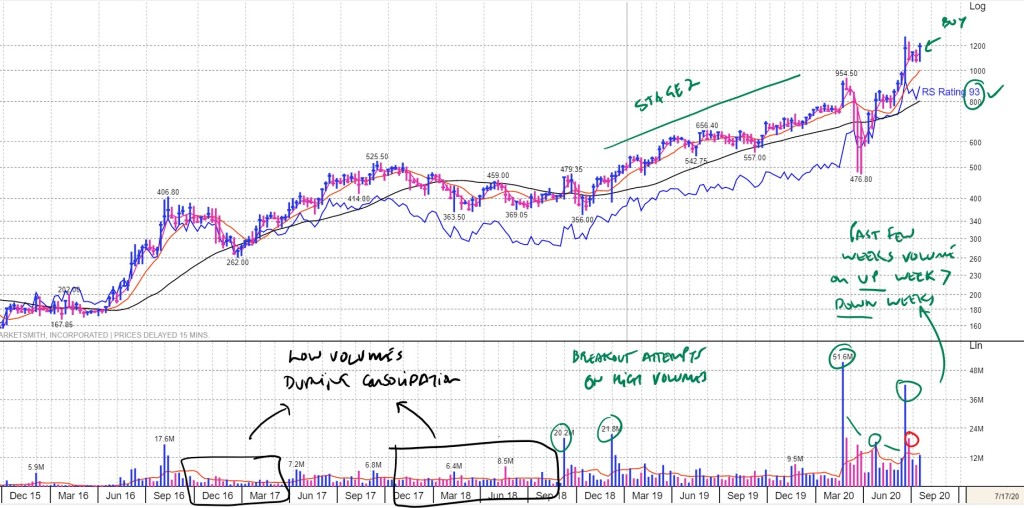

Weekly Chart

Daily Chart

Bearings – Category

- I categorize Muthoot Finance as a Market Leader in gold loans.

- I also categorize Muthoot as a Cyclical as the attractiveness of gold loans increases when gold prices increase and when other forms of credit are either unavailable or expensive.

- I know the business reasonably well. It has been on my wish list for some time.

Price – Volume

- The market is in an uptrend.

- Muthoot and Manapurram have a relative strength ranking of 93 and 80 respectively, indicating gold loan NBFC’s are a leadership group.

- Moreover, prior to the Covid19 crash Muthoot had been in a classic stage 2 run up delivering a 100%+ return from Jan 2019 to Feb 2020, with support at the 200 day ma line.

- In fact the stock hit is all time high just the week prior to the March crash

- Post the crash, a very sharp volatility contraction played out with volumes declining from left to right.

- Price> 21 day ma > 50 day ma >200 day ma; with all point up.

- The first buyable day that fit the above trend template was 27 May 2020.

- On 18 and 19 June there was a gap up and breakout on huge volumes. Thereafter, volatility spiked and but on each down day volumes were lower than the preceding up day.

- There should be limited overhead supply as the stock is at its’ 52 week high.

Valuation

- Market capitalization = Rs48,000crs.

- PAT 2020 ~3000crs. So P/E = 16x. The relative attractiveness of this valuation comes down to your belief whether the key driver of earnings growth over the last few years is dominated by cyclical and transient factors or structural factors i.e. are earnings sustainable at these levels or is Rs3,000cr+ the new normal for Muthoot Finance?

- BV~ Rs11,600crs. So P/BV ~ 4x. If BVPS grows at 15% over the next 10 years (last 7 years ~16% pa) and P/BV multiple declines from 4x to 3x; then your compounded return ~12.5% pa + dividends (~1%+).

- So at this price there may be no margin of safety for a buy and hold investor, but if you believe the underlying business has a strong cyclical component, then you can play the expected delta in earnings and expectations.

Financial

- Q4 2020 EPS grew by 59% and FY 2020 EPS grew by 50%+

- Company expects to grow the loan book 15% in FY2021

- Most analysts covering the stock have a buy rating. While this is a classic sign of an overcrowded trade, it also fuel for momentum IF earnings growth can beat expectations and result in earnings revision. The drivers for potentially beating expectations are certainly in place.

- Rising gold prices provide a natural kicker to earnings. Gold prices is a key monitoring item.

- Management attributes part of the FY2020 growth in their loan book to the NBFC crises. So someone else’s pain was their opportunity. Post Covid19, many NBFC players will continue to have their hands tied behind their back. More data will come as the financial sector comes out of the moratorium period.

- So higher gold prices + constrained credit environment provides a win-win solution to both borrower and lender : higher gold prices translates into higher collateral value and hence higher loan value for customers. Further, gold loans have one the lowest loss given default rates. Key things to monitor are average loan to value ratios and average duration of loans.

- Muthoot as the #1 player in gold loans is likely to be a beneficiary as the market expands due to entry of other financial institutions. Anything that accords greater legitimacy to gold loans mitigates the tail risk associated with their negative perception.

- Have a look at their balance sheet and investor presentation to get a sense of their financial strength and the absence of any major asset liability mismatch. This financial strength seen in the context of asset quality and a constrained consumer loan environment suggests that that their funding cost will not increase over the year.

How the trade gets screwed?

- I regret not buying Muthoot during the crash: During the March crash, my portfolio allocation increased from 40% equities to 75% equities. I wanted to maintain a buffer against further declines, so I passed the opportunity to buy Muthoot then. Given their recent results, I regret not buying.

- The base may be faulty: After the 18 June breakout, the follow through failed and volatility spiked.

- Muthoot has become crowded trade: 94% of the company is owned by promoters and institutions. While you want a low float so that institutional buying drives prices up, here you are actually exposed to institutional selling. Further, all analysts have buy ratings on the stock and the stock has become a proxy for higher gold prices. Any miss in earnings is likely to result in gap downs.

- Decline in gold prices: This is a signpost to exit the stock. As gold prices decline increases the probability of earnings decline/miss and increase the probability loss given default

- Gold Loan cycle competition: Gold loans are becoming a hot segment in an otherwise risk averse credit market. Many banks are going to enter this segment and others such as DCB, Federal Bank, SBI etc are reporting an increase in disbursement. If banks get serious in this vertical, it may spoil the party for Muthoot. Some signposts that I will be looking for especially from State Bank of India and South India focused banks:

- Special windows that disburse loans in a few hours. One of the key advantages that Muthoot enjoys over banks is very quick disbursement of gold loans. If banks can combine their low cost gold loans with a quick turnaround time, a key strength of Muthoot gets negated. Note over the past few years SBI has reduced the time take from disbursing gold loans to 10 days.

- Flexible payment terms.

- Higher funding costs: As competition increases, Muthoot may not be able to pass on higher funding costs. So net interest margins will contract. For context, SBI offers gold loans at 7.5% vs Muthoot at 12%

- South India disruption: ~50% of the loan book is concentrated in the South. Majority of which is in Kerela. Any disruption in economic life (weather/pandemic etc) will impact loan growth, utilization levels of capital (Eg: you borrow for 6 months, but utilize it multiple times to give out 2-3 month loans)

- I don’t stick to my stop loss: Familiarity and Regret of missing out may cause me to average down and not stick with my 9% stop loss

Please note the above learning note is not investment advice.